For Employers

and Participants

FIDUCIARY RESPONSIBILITY IS OUR FOCUS

Retirement Readiness is Our Mission

Comprehensive Solution

Sponsors can offer participants a retirement readiness solution while meeting their fiduciary responsibility obligations.

Process & Efficiency

Improve process and increase efficiency by implementing a standard workflow and addressing the fiduciary duty services of sponsors.

Benefit & Education

Provide customized education to participants dependent on their retirement readiness qualification, providing a true 401(k) benefit.

Is your current advisor looking into SOK™? Let us get in touch with them.

Contact UsLooking for a current SOK™ advisor? Let us pair you with one of our verified advisors.

Contact Us

We know that there is no one-size fits all approach to retirement planning. SOK™ advisors utilize our readiness calculator and participant’s risk profile to see the participant’s “bigger” financial and retirement picture in order to develop a unique plan for them.

Standard of (k)are™ uses innovative technology, critical thinking, and continuing education to create each participant’s comprehensive retirement.

(k)ustom Education: Our new technology allows us to track participant’s retirement financial goals, if they are being met, what adjustments they may need to take, and send email reminders directly to participants. This automated, ongoing communication will allow further education for participants and help them better understand the actions they need to take for their Retirement Readiness.

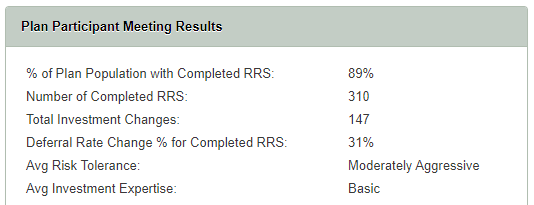

Advisors and Plan Sponsors get access to data regarding the meeting results to better understand their Plan Participants.

There is a better way to prepare participants for retirement and reduce fiduciary liability. Contact us today to find out how.

BOARDROOM

SERVICES

Standard of (k)are™ focuses on retirement readiness while limiting the fiduciary liability of plan sponsors. We understand there is a shared responsibility between fiduciary and participant, and have created a retirement plan management program that addresses these requirements.

Standard of (k)are™ follows participants’ Retirement Readiness. Our standardized process and ongoing documentation drive and measure ultimate plan success.

Fiduciary Document Management

Standard of (k)are™ is built by industry experts who understand the fiduciary and legal documentation requirements set forth by the Department of Labor. We keep all retirement plan and fiduciary risk management documents in one secure location. The result is improved workflow, efficiency and minimized mistakes and liability.

Plan Activity Documentation

To act prudently is one of the fiduciary’s central duties. Standard of (k)are™ fulfills this responsibility by standardizing the activity documentation process in a format unlike anything else in the industry. SOK™ is the first tool that truly measures ultimate plan success through its Retirement Readiness and fiduciary focus. Providing advisors, sponsors, and participants a clear demonstration of value over time sets SOK™ apart from any other available option.

Investment Committee Archive

Many of the rules regarding a 401(k) plan, which your investment committee must know, stem from the Employee Retirement Income Security Act (ERISA). By documenting investment committee meeting minutes, all discussion points and actionable results are captured. This important step substantially reduces fiduciary risk.

Client Resource Manager (CRM)

Standard of (k)are™ incorporates a sophisticated Client Resource Manager (CRM) to track plan and participant contact information, notes, documents, and other fiduciary and data management information. This CRM also serves as a centralized database for storage of plan records and activity management, with the ability to connect the advisor with the sponsor, investment committee members, and participants.

Regular communication, critical major milestone checkpoints, and considering a participant’s entire financial portfolio within their 401(k) plan provides a true Retirement Readiness picture.

BREAK ROOM

SERVICES

401(k) plan participants put trust in plan sponsors to oversee their retirement funds. However, most plan sponsors cannot report on the overall retirement readiness health of their plan participants.

Retirement readiness, or the participants’ ability to successfully retire, is one of the reasons Standard of (k)are™ was developed. Recognizing the responsibility of the fiduciary is the second.

Sponsors that use Standard of (k)are™ fulfill their fiduciary obligations while providing a better service for their participants.

Retirement Readiness of Participants

The majority of workers underestimate their cost of living and the amount of savings that will be needed for them to live comfortably during retirement. Many don’t understand the benefits or implications of a 401(k).

The comprehensive Standard of (k)are™ 401(k) retirement calculator considers current budget, other sources of income, outside factors, spouse information and future estimates to paint the participant’s realistic and holistic retirement readiness picture.

Participant Education Focus

A participant’s Retirement Readiness depends on their lifestyle choices and making informed decisions.

Frequently, employers don’t provide their employees with necessary information regarding retirement benefits. As a result, most employees do not know enough about their 401(k) to make educated decisions for their future.

Standard of (k)are™ aids Retirement Plan Sponsors in educating and informing participants by following the application’s processes and workflow.

Is your current advisor looking into SOK™? Let us get in touch with them.

Contact UsLooking for a current SOK™ advisor? Let us pair you with one of our verified advisors.

Contact Us